Home

>

Gold Nisab value

November 17, 2024

Gold Nisab value: Zakat on gold and silver

By Yusuf Jaffar

•

3 min read

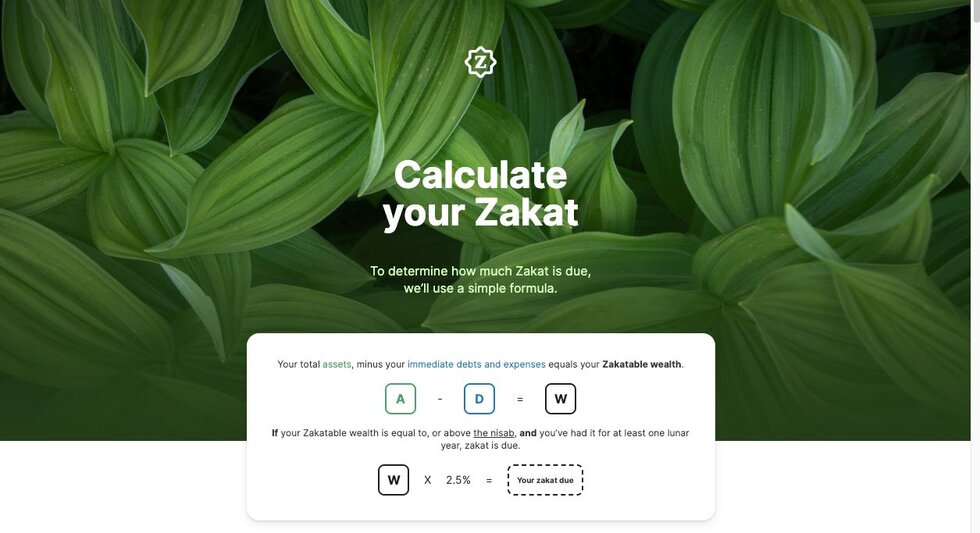

Zakat is a cornerstone of Islamic faith, a sacred duty that purifies wealth and uplifts communities. While monetary contributions often take the spotlight, Zakat on gold and silver holds profound historical and religious significance. As precious metals that symbolize wealth, understanding how to calculate Zakat on gold and silver is crucial for fulfilling this spiritual obligation with precision and care.

At LaunchGood, we’re here to make this process simple and accessible. This blog will walk you through essential guidelines to calculate Zakat on gold. Whether you're new to Zakat or looking for clarity, you're in the right place to begin your journey.

Workout the Zakat on gold in Islam

Key conditions for Zakat

Nisab for gold: The Nisab for gold is 85 grams of pure gold, equivalent to 20 mithqal, or its monetary value. If the gold you own equals or exceeds this threshold, Zakat becomes obligatory.

Nisab for silver: The Nisab for silver is 612.36 grams. This lower threshold often makes Zakat on silver more accessible and impactful.

Purity of gold and silver: For gold or silver mixed with other metals (e.g., 18K or 21K gold), calculate the pure content using the formula:

Pure Metal Weight = (Total Weight × Carat Value) / 24

Ownership period: Zakat is only applicable if gold or silver has been owned for a full lunar year (Islamic calendar year). There are different views regarding whether or not each gold/silver acquired must have been owned for an entire year. The Hanafi view is that it is just necessary to have nisab of gold/silver for an entire year, not each and every piece of gold/silver. If someone had 87 grams of gold and the beginning of year and then one day before his zakat date buys 100 grams more, according to this view, they would pay zakat on the entire thing

Intended use: Gold or silver intended for personal use (e.g., jewelry) may or may not be subject to Zakat based on the school of thought:

The Hanafi school requires Zakat on all gold and silver, including jewelry.

Other schools, such as Shafi’i, Maliki, and Hanbali, exempt jewelry worn regularly unless it exceeds customary limits (Uruf)

Find Zakat eligible campaigns below.

Step-by-step guide to calculating Zakat on gold and silver

Step 1: Determine the weight of your assets

Weigh all the gold and silver you own, including:

Jewelry, if applicable under your school of thought.

Gold and silver bars, coins, or other assets.

Exclude non-metal components (e.g., gemstones) to determine the net weight.

Formula example:

If you have a gold ring weighing 10 grams with a gemstone of 1.5 carats:

Gemstone Weight = 1.5 × 0.2 = 0.3 grams

Net Gold Weight = 10 − 0.3 = 9.7 grams

Jewelry, if applicable under your school of thought.

Gold and silver bars, coins, or other assets.

Exclude non-metal components (e.g., gemstones) to determine the net weight.

If you have a gold ring weighing 10 grams with a gemstone of 1.5 carats:

Gemstone Weight = 1.5 × 0.2 = 0.3 grams

Net Gold Weight = 10 − 0.3 = 9.7 grams

Step 2: Check the purity of your assets

Identify the karatage of your gold or silver (e.g., 24K, 22K, 18K). Convert it to pure weight using:

Pure Metal Weight = (Weight × Karat) / 24

Pure Metal Weight = (Weight × Karat) / 24

Step 3: Find the current market price

Look up the current price of 1 gram of pure gold or silver from reliable sources such as local jewelers, online trackers, or financial institutions.

Step 4: Calculate the total value

Multiply the net weight of your pure gold or silver by its market price:

Total Value = Pure Metal Weight × Price per Gram

Total Value = Pure Metal Weight × Price per Gram

Step 5: Determine if you meet the nisab threshold

Compare your total value to the Nisab threshold:

Gold: 85 grams of pure gold or its monetary equivalent.

Silver: 612.36 grams of pure silver or its monetary equivalent.

If your total value meets or exceeds the threshold, Zakat is due.

Gold: 85 grams of pure gold or its monetary equivalent.

Silver: 612.36 grams of pure silver or its monetary equivalent.

Step 6: Calculate Zakat amount

Apply the Zakat rate (2.5%):

Zakat Amount = Total Value × 0.025

Zakat Amount = Total Value × 0.025

Step 7: Pay Zakat

Pay the calculated Zakat amount in cash or as an equivalent amount of physical gold or silver. Ensure it is distributed to eligible recipients such as the poor and needy.

Example Calculations

Example 1: You own 100 grams of 18K gold. The current market price for 1 gram of pure gold is $60.

Step 1: Convert to pure gold:

Pure Gold Weight = (100 × 18) / 24 = 75 grams

Step 2: Calculate total value:

Total Value = 75 × 60 = $4,500

Step 3: Check Nisab:

Since 75 grams is below the gold Nisab of 85 grams, no Zakat is due.

Example 2: Suppose you have a gold ring with:

Total weight: 10 grams

A sapphire gemstone measuring 8 x 6 mm (approximately 1.5 carats)

Step 1: Convert gemstone weight to grams

To convert carats to grams, multiply the gemstone weight by 0.2 (as 1 carat equals 0.2 grams):

Weight in grams = 1.5 × 0.2 = 0.3 grams

Step 2: Subtract gemstone weight from the total weight

Remove the gemstone weight to determine the net gold weight:

Net Gold Weight = 10 − 0.3 = 9.7 grams

Step 3: Use the net gold weight for Zakat calculations

With the gemstone weight excluded, use the net gold weight of 9.7 grams to assess if it meets the Nisab threshold and to proceed with further calculations.

Step 1: Convert to pure gold:

Pure Gold Weight = (100 × 18) / 24 = 75 grams

Step 2: Calculate total value:

Total Value = 75 × 60 = $4,500

Step 3: Check Nisab:

Since 75 grams is below the gold Nisab of 85 grams, no Zakat is due.

Total weight: 10 grams

A sapphire gemstone measuring 8 x 6 mm (approximately 1.5 carats)

To convert carats to grams, multiply the gemstone weight by 0.2 (as 1 carat equals 0.2 grams):

Weight in grams = 1.5 × 0.2 = 0.3 grams

Remove the gemstone weight to determine the net gold weight:

Net Gold Weight = 10 − 0.3 = 9.7 grams

With the gemstone weight excluded, use the net gold weight of 9.7 grams to assess if it meets the Nisab threshold and to proceed with further calculations.

Why we should pay Zakat according to the silver nisab?

Essentially, there is a significant discrepancy in value when it comes to paying Zakat based on the silver versus gold nisab. On average, the nisab for gold is around $7,500, whereas the nisab for silver starts at $586. Choosing to calculate your Zakat based on the silver nisab would lead to: Accessibility through lower nisab

The silver Nisab is significantly lower in monetary value compared to gold, making it more accessible to a larger group of Muslims.

Maximizing wealth redistribution

By enabling more people to pay Zakat, the silver standard ensures greater collection and distribution, directly benefiting the poor and needy.

Practical simplicity

The affordability of silver encourages regular Zakat payment, ensuring fulfillment of this spiritual obligation.

Featured fundraisers

Discover 1.5K more

Join our newsletter

Join our community of 700k subscribers

Explore more