Home

>

When is Zakat due?

November 17, 2024

When to pay zakat: complete guide on obligations, timing, and best practices

By Yusuf Jaffar

•

3 min read

Zakat is one of the pillars of Islam

At LaunchGood, we understand that many Muslims have questions about when and how to fulfill their Zakat obligations, ensuring their contributions align with both spiritual and practical guidance.

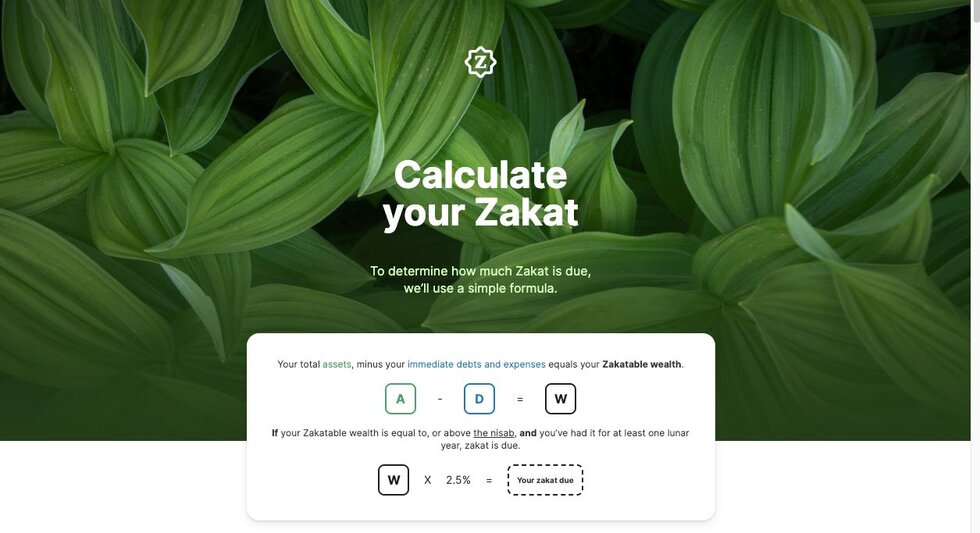

That’s why we’ve created a comprehensive Zakat Calculator to help you determine your dues with ease.

To deepen your understanding in this blog, we've grouped key information under three main areas to guide you on this journey:

When did Muslims start paying Zakat: Discover the origins of Zakat and its establishment as a critical aspect of Islamic practice.

When do you have to pay your Zakat: Clarify the rules and timelines for fulfilling this obligation based on Islamic principles.

The best times to give Zakat: Explore optimal moments to pay Zakat for maximum spiritual and communal impact.

When did Muslims start paying Zakat

Muslims began paying Zakat as a formal obligation approximately 18 months after the Prophet Muhammad's ﷺ migration to Madina, when it was declared a mandatory duty (Fard) on Muslims. This took place after clear directives regarding Zakat were revealed in the Quran, leading the Prophet ﷺ to organize workers who would collect and distribute it.

The first statutory system for Zakat collection and enforcement was established by Caliph Abu Bakr (RA) after the Prophet's ﷺ passing.

Zakat was a cornerstone of the early Islamic state, serving religious, social, economic, and political purposes that contributed to the holistic development of the Muslim community.

Religious and spiritual role

As one of the Five Pillars of Islam, Zakat was a mandatory act of worship that purified both wealth and the soul of the giver. It symbolized submission to Allah and deepened the spiritual bond between Muslims and their Creator.

The Quran underscores its purifying nature:

"Take charity from their wealth in order that they are thereby cleansed and purified" (Quran 9:103).

Social welfare

Zakat was a powerful tool for promoting social justice and alleviating poverty. By redistributing wealth from the affluent to the underprivileged—such as the poor, orphans, widows, and those in debt—Zakat reduced economic inequality and fostered a sense of community.

During the reign of Caliph Umar ibn Abdul Aziz (717–720 CE), the efficient management of Zakat reportedly eliminated poverty in Medina.

Economic impact

The Zakat system encouraged the circulation of wealth and discouraged hoarding, ensuring resources were used productively. This boosted the purchasing power of the poor and stabilized the economy.

A tax of 2.5% on surplus wealth created a sustainable flow of funds for public welfare projects and economic growth, benefiting the entire community.

Political significance

Zakat became a symbol of allegiance to Islamic authority. Under Caliph Abu Bakr, it was institutionalized as a state-administered system, and its enforcement was pivotal during the Ridda Wars when some tribes refused to pay.

The funds collected were managed by the public treasury (Baitul Mal), supporting governance, military efforts, and public services.

Find Zakat eligible campaigns below.

When do you have to pay your Zakat

Zakat becomes obligatory when a Muslim's wealth equals or exceeds the Nisab threshold (the minimum amount required for Zakat to be due) and remains above this level for one full lunar year, known as Hawl. Understanding the timing of Zakat payments is crucial to fulfilling this obligation properly.

Key Points on Timing

1. Zakat Anniversary

The date your wealth first surpasses the Nisab marks the beginning of your Zakat year.

Zakat becomes due on this same date annually.

2. Immediate Payment

Zakat should be paid as soon as it becomes due on your Zakat anniversary.

Unnecessary delays in payment are discouraged and should be avoided.

3. Advance Payment

Zakat can be paid in advance, such as during Ramadan, to benefit from the increased rewards of this holy month.

When your actual Zakat anniversary arrives, ensure the correct amount has been paid. If adjustments are needed, you must account for any shortfall or surplus.

4. Special Cases

For specific types of wealth, such as crops or minerals (known as "windfalls"), Zakat is due immediately upon harvest or discovery.

This type of wealth does not require the completion of a full lunar year.

Your Zakat anniversary marks the date when your wealth first exceeded the Nisab threshold and remained above it for a full lunar year (354 days). Each year on this date, you are required to reassess your wealth, ensuring it still surpasses the Nisab. If it does, you calculate and pay 2.5% of your eligible assets as Zakat.

The best times to give Zakat

The timing of Zakat payments can vary based on individual circumstances, but there are specific periods and considerations that many Muslims follow to maximize the spiritual and social impact of their giving.

On Your Zakat due date

Zakat becomes obligatory once your wealth exceeds the Nisab threshold for a full lunar year. It is essential to pay your Zakat immediately on your Zakat anniversary to fulfill the obligation without unnecessary delay.

During Ramadan

While not obligatory, paying Zakat during Ramadan is a common and highly recommended practice. This is because acts of worship, including Zakat, bring multiplied rewards during this blessed month.

The Prophet Muhammad ﷺ was known for increasing his charitable giving in Ramadan.

Many Muslims align their Zakat payments with Ramadan for spiritual benefits, even if their Zakat anniversary falls at a different time. If Zakat is paid early, adjustments can be made on the actual due date.

3. In times of urgent need

Zakat can be particularly impactful during times of crisis, such as natural disasters, famine, or war. Paying Zakat in these moments helps alleviate immediate suffering and aligns with the social justice goals of Zakat.

4. Other blessed times

Aside from Ramadan, other spiritually significant periods, such as the first ten days of Dhul Hijjah, are also ideal for paying Zakat. Giving during these times can enhance the rewards and blessings of this act of worship.

When paying Zakat, it is highly recommended to recite the following du'a (supplication) to seek Allah's acceptance and blessings:

Arabic:

اللَّهُمَّ اجْعَلْهَا مَغْنَمًا وَلاَ تَجْعَلْهَا مَغْرَمًا

Transliteration:

Allahumma aj‘alha maghnaman wa la taj‘alha maghraman

Translation:

"O Allah, make it a gain and do not make it a loss!"

This supplication is derived from a narration by the companion Abu Hurayrah (may Allah be pleased with him), who reported that the Prophet Muhammad ﷺ recommended saying this du'a while giving Zakat. It serves as a reminder of the immense reward attached to Zakat and a way to seek Allah’s blessings and acceptance of this act of worship.

Featured fundraisers

Discover 1.5K more

Join our newsletter

Join our community of 700k subscribers

Explore more