Home

>

Zakat al-Fitr 2025

November 17, 2024

Zakat al-Fitr 2024: How to calculate and pay your Fitrah for Eid

By Yusuf Jaffar

•

3 min read

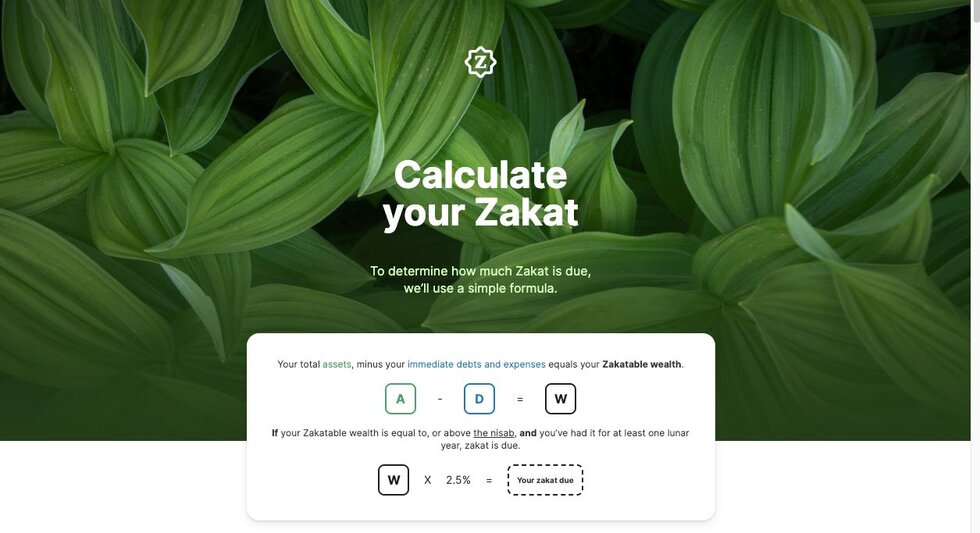

As the holy month of Ramadan comes to an end, Muslims around the world prepare to celebrate Eid al Fitr, a time of joy, gratitude, and giving. Central to this celebration is the fulfillment of Zakat al Fitr, a special form of charity that ensures no one is left behind during this blessed time. At LaunchGood, we’re committed to making your acts of giving meaningful and impactful, so we’ve created this comprehensive guide to help you understand, calculate, and fulfill your Zakat al-Fitr obligations with ease.

In this guide, we’ll explore:

Understanding Zakat al Fitr and Its meaning, diving into its significance and the amounts required.

Calculating and paying Fitrah for 2025, with clear instructions to meet this obligation accurately.

Zakat and Fitrah Obligations for Eid al Fitr, focusing on how and when to pay Zakat al Fitr to maximize its benefits.

Understanding Zakat al Fitr and Its meaning

Zakat al-Fitr, also known as Sadaqat al-Fitr or Zakat al-Fitrah, is a mandatory form of charity in Islam that is closely tied to the conclusion of Ramadan. It serves both spiritual and social purposes, emphasizing gratitude, purification, and community support.

Definition and obligation

Zakat al-Fitr is a compulsory duty (wajib) for every Muslim, regardless of age or gender, provided they have the means to give. It was instituted by the Prophet Muhammad (peace be upon him) in the second year of Hijrah. The head of a household is responsible for paying it on behalf of all dependents, including children and those without their own wealth.

The amount due is traditionally measured as one saa' (approximately 2.6–3 kg) of staple food such as dates, barley, wheat, or rice. Alternatively, its monetary equivalent can be given if food distribution is impractical. Note: The vast majority of mazhabs (all except the hanafis) require it be given in food unless not possible.

Purpose

The primary goals of Zakat al-Fitr are:

Purification: It purifies the fasting person from any shortcomings in their fast, such as idle talk or minor transgressions.

Support for the needy: It ensures that the poor and underprivileged can partake in the joy of Eid al-Fitr by providing them with food or financial assistance.

Gratitude to Allah: It expresses thankfulness for being able to complete Ramadan's fasts.

Timing

Zakat al-Fitr becomes obligatory at sunset on the last day of Ramadan and must be paid before the Eid prayer. However, it is permissible to pay it earlier during Ramadan to ensure timely distribution to those in need. If paid after the Eid day, it is considered general charity (sadaqah) rather than Zakat al-Fitr. Note: Scholars differ in opinions on this, some scholars only allow paying a few days before (Hanbali and Maliki), some allow from the beginning of Ramadan (Shafi), some allow the payment even before Ramadan (Hanafi).

Recipients

The recipients of Zakat al-Fitr are primarily the poor and needy within the Muslim community. Its purpose is to enable them to celebrate Eid with dignity and joy. It cannot be given to wealthy individuals or non-Muslims.

Find Zakat al Fitr campaigns below.

How much is Zakat al Fitr 2025?

Different countries determine the Zakat al-Fitr (Fitrah) amounts each year based on the cost of staple foods commonly consumed in their region. This is calculated to reflect the equivalent of one saa' (approximately 2.5–3 kg) of food, as prescribed in Islamic tradition. Here's how the process generally works:

Factors Influencing Fitrah Calculation

Staple Food Prices:

The cost of staple foods such as rice, wheat, barley, or dates in the local market is used as a benchmark. For example:

In Canada, the amount is often based on 3 kg of rice.

In Singapore, the rate reflects the median price of 2.3 kg of rice, with adjustments for higher-grade varieties like basmati or brown rice.

Local Economic Conditions:

The calculation considers local economic factors such as inflation and the cost of living. For instance, organizations may use Consumer Price Indexes (CPI) or market surveys to determine accurate amounts.

Religious Guidelines:

The determination aligns with Islamic principles and rulings from scholars or religious councils. Some schools of thought allow monetary equivalents instead of food, while others prefer direct food distribution.

Regional Religious Authorities:

In many countries, religious organizations or councils set the standardized rates annually to ensure consistency and fairness within the community. For example:

The Islamic Religious Council of Singapore (MUIS) sets rates based on rice prices.

In Australia, organizations like ANIC recommend specific monetary amounts for ease of payment.

The cost of staple foods such as rice, wheat, barley, or dates in the local market is used as a benchmark. For example:

In Canada, the amount is often based on 3 kg of rice.

In Singapore, the rate reflects the median price of 2.3 kg of rice, with adjustments for higher-grade varieties like basmati or brown rice.

The calculation considers local economic factors such as inflation and the cost of living. For instance, organizations may use Consumer Price Indexes (CPI) or market surveys to determine accurate amounts.

The determination aligns with Islamic principles and rulings from scholars or religious councils. Some schools of thought allow monetary equivalents instead of food, while others prefer direct food distribution.

In many countries, religious organizations or councils set the standardized rates annually to ensure consistency and fairness within the community. For example:

The Islamic Religious Council of Singapore (MUIS) sets rates based on rice prices.

In Australia, organizations like ANIC recommend specific monetary amounts for ease of payment.

Examples by Country

United Kingdom: The amount is determined by calculating the cost of one saa' of staple food, with a current recommendation around £6.50 per person.

Canada: Typically set at CAD $10–$15 per person, reflecting the cost of 3 kg of rice or other staples.

United States: Commonly ranges from $10–$15 per person, based on local food prices and CPI data for staples like flour or rice.

Australia: Rates are often standardized nationally; for example, AUS $18 was recommended in 2024 based on staple food costs.

Malaysia: Rates vary depending on the type and quality of rice consumed; they are set by state-level Islamic authorities.

Singapore: MUIS sets two rates—one for regular-grade rice (e.g., $5) and another for higher-grade varieties (e.g., $7.70).

Zakat and Fitrah obligations for Eid al Fitr

Form of Payment:

Traditionally, Zakat al-Fitr is paid in the form of staple food (e.g., rice, wheat, dates) equivalent to one saa' (approximately 2.5–3 kg) per person.

Some scholars may permit monetary equivalents if it better serves the needs of recipients or simplifies distribution.

Intention (Niyyah):

The payer must make the intention that this is Zakat al-Fitr, an act of worship and obedience to Allah. This intention can be made silently in the heart.Distribution:

It should be given directly to eligible recipients (the poor and needy) or through trusted mosques and Islamic organizations that distribute it according to Islamic guidelines.

The goal is to ensure that recipients receive the aid in time for Eid celebrations.

Key Guidelines

Who Pays:

According to most scholars every Muslim who has surplus food or wealth beyond their needs for one day and night must pay Zakat al-Fitr for themselves and their dependents (e.g., children, spouse).Recipients:

It is specifically directed toward poor Muslims to enable them to partake in Eid festivities. It cannot be given to non-Muslims or wealthy individuals.Practical Tips

Pay early during Ramadan if using charities to ensure timely distribution.

If paying in kind (food), ensure it matches local staple foods.

Verify that charitable organizations distribute Zakat al-Fitr at the prescribed time.

No specific dua required:

When paying Zakat al-Fitr, there is no specific dua (supplication) that must be recited. However, it is essential to have the intention (niyyah) in your heart that you are fulfilling the obligation of Zakat al-Fitr as an act of worship and obedience to Allah.General supplications for Eid:

On the day of Eid, Muslims often exchange the following supplication as a general prayer of acceptance:"Taqabbal Allahu minna wa minkum"

“May Allah accept (good deeds) from us and from you.”Glorifying Allah with the takbeer:

It is highly recommended to recite the Takbeer during this time to glorify Allah:"Allahu Akbar, Allahu Akbar, la ilaha ill-Allah, wa Allahu Akbar, Allahu Akbar, wa Lillah il-hamd"

“Allah is the Greatest, Allah is the Greatest, there is no god but Allah, Allah is the Greatest, Allah is the Greatest, and to Allah belongs all praise.”These phrases reflect gratitude and devotion but are not specifically tied to the act of paying Zakat al-Fitr itself.

Focus on sincerity:

The primary focus should be on fulfilling the obligation with sincerity and ensuring that it reaches those in need before the Eid prayer.Visit LaunchGood.com in Ramadan to find opportunities to pay your Zakat al Fitr.

Featured fundraisers

Discover 1.5K more

Join our newsletter

Join our community of 700k subscribers

Explore more