Home

>

Zakat on cash, property and stocks

November 17, 2024

How to calculate Zakat on cash, property, stocks, and investments

By Yusuf Jaffar

•

3 min read

Zakat is a significant act of worship in Islam, emphasizing purification of wealth and aiding those in need. Whether you pay Zakat on your savings or income depends on your financial habits and circumstances. Below is a detailed breakdown to help you decide:

Zakat on savings

You are required to pay Zakat on your savings if:

Condition: Your total wealth (cash, investments, etc.) exceeds the nisab (the value of 85 grams of gold or 595 grams of silver) and has been held for one lunar year (haul).

What counts as savings?

Savings include:

Cash in bank accounts

Fixed deposits

Investments (e.g., stocks, bonds, mutual funds)

Gold, silver, or other liquid assets

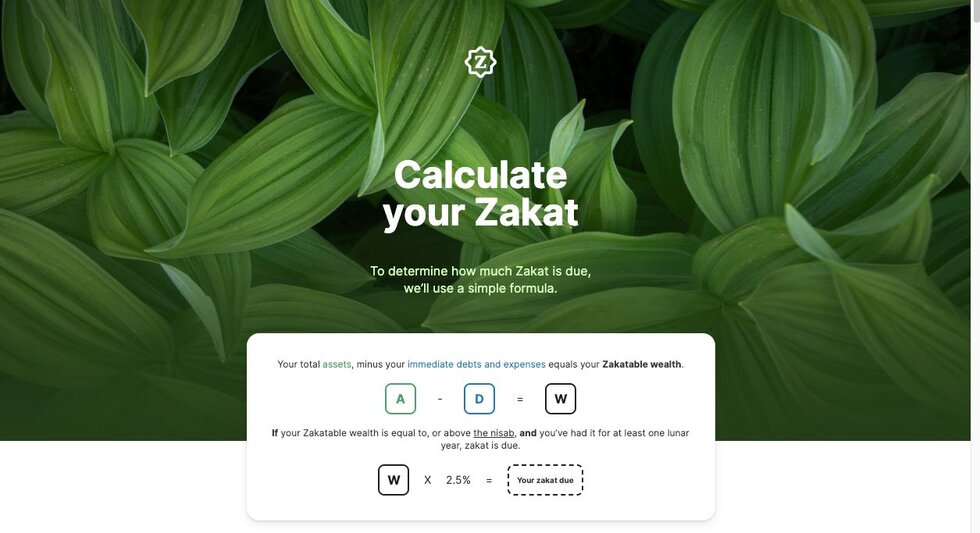

How to calculate Zakat on savings

Zakat is calculated at 2.5% of the total savings that meet the nisab threshold.

Example calculation:

If your savings amount to $10,000 and exceed the nisab threshold, the calculation for Zakat is as follows:

Zakat = Savings × 0.025

Zakat = 10,000 × 0.025

Zakat = 250

You would pay $250 as Zakat.

Key point: Savings are the primary focus of Zakat, as they represent stored wealth not actively used for daily needs.

Zakat on income

You may choose to pay Zakat on your income if:

Condition: You prefer to calculate Zakat immediately upon receiving income (e.g., salary, business profits) without waiting for it to accumulate over a year.

Why pay Zakat on income?

Simplifies calculations and ensures timely contribution.

Beneficial if you don’t save much but want to fulfill your obligation regularly.

How to calculate Zakat on income

Deduct necessary living expenses (e.g., rent, food, utilities) and immediate debts from your income. Pay Zakat on the remaining surplus at 2.5%.

Example calculation:

If your monthly income is $5,000 and your living expenses are $4,000, the calculation for Zakat is as follows:

Zakat = (Income - Expenses) × 0.025

Zakat = (5,000 - 4,000) × 0.025

Zakat = 1,000 × 0.025 = 25

You would pay $25 as Zakat.

Practical recommendation

For regular savers: Focus on paying Zakat on your savings annually.

For non-savers: Pay Zakat on surplus income regularly.

Ensure all eligible wealth (savings + income) is accounted for in your annual Zakat calculation.

Types of income subject to Zakat

Zakat applies to various forms of income, provided they meet the nisab threshold after necessary deductions. Below is a breakdown of income types subject to Zakat:

Employment income: Includes salaries, wages, allowances, bonuses, commissions, and emoluments derived from services or labor rendered.

Professional fees: Income earned from professional services, such as consultancy fees or freelance work.

Rental income: Earnings from leasing properties or assets, subject to Zakat if they exceed the nisab after deducting necessary expenses.

Business profits: Profits generated from business activities, including trade and commerce, and the value of goods intended for sale.

Investment returns: Includes income from investments such as dividends, halal interest, and returns on shares or mutual funds, subject to Zakat if it meets the nisab threshold.

Agricultural produce: Income from crops or harvests is zakatable at a rate of 5%–10%, depending on whether the land is irrigated naturally or artificially.

Livestock: Earnings from livestock (e.g., through sales or dairy production), subject to Zakat if the livestock exceeds specific thresholds.

Royalties: Royalties earned from intellectual property or creative works are included in zakatable income.

Find Zakat eligible campaigns below.

Zakat on property

Zakat on property depends on the purpose of ownership and the type of property. The guidelines ensure clarity in determining whether Zakat is applicable and how it should be calculated.

Properties exempt from Zakat: Properties used for personal purposes are generally exempt from Zakat. This includes:

Primary residence: The house you live in.

Personal use properties: Properties owned for personal or family use, such as a second home for dependents.

Rental properties (value): The market value of rental properties is exempt unless they are intended for resale. However, Zakat applies to rental income if it exceeds the nisab and is held for one lunar year (haul).

Properties subject to Zakat:

Investment properties: Properties purchased with the intention of resale or capital gains are treated as trade goods (mal tijarah). Zakat is due annually on their current market value at a rate of 2.5%, provided they meet the nisab threshold and are held for a full lunar year.

Example:

If an investment property is worth $500,000:

Zakat = $500,000 × 0.025 = $12,500

Rental income: Zakat is due on net rental income (after deducting expenses like maintenance, taxes, and repairs) if it meets the nisab and is held for one lunar year.

Example:

If monthly rental income is $1,000 and expenses are $300:

Net income = $700/month

Annual net income = $8,400

Zakat = $8,400 × 0.025 = $210

Undeveloped land: Land purchased with the intention to sell in the future incurs Zakat annually on its market value. Land held for personal use (e.g., farming or future construction) is not subject to Zakat.

Zakat on stocks and investments

Zakat on stocks, investments, and retirement accounts like 401(k) depends on the nature of the asset and its accessibility. Below is a detailed breakdown.

Zakat on stocks and shares

Stocks held for resale (trade):

If you own stocks with the intention of reselling them for profit, they are treated as trade goods (mal tijarah).

Zakat calculation:

Pay Zakat on the current market value of the stocks at a rate of 2.5%.

Example:

If your portfolio is worth $10,000:

Zakat = 10,000 × 0.025 = 250

You would pay $250 as Zakat.

Stocks held for long-term investment:

For stocks held as long-term investments (not for resale), Zakat is due only on the Zakatable assets of the company, such as cash, receivables, and inventory. Fixed assets like buildings and machinery are excluded.

Simplified method:

Many scholars recommend taking 25% of the stock's market value as a proxy for Zakatable assets and then paying 2.5% on that amount.

Example:

If your portfolio is worth $10,000:

Zakatable amount = 10,000 × 0.25 = 2,500

Zakat = 2,500 × 0.025 = 62.50

You would pay $62.50 as Zakat.

Zakat on retirement accounts (e.g., 401(k), IRA)

Accessibility and ownership:

Zakat is due only on wealth that you fully own and can access. For retirement accounts like a 401(k), where early withdrawal incurs penalties and taxes:

Calculate Zakat on the withdrawable amount after deducting penalties and taxes.

Example:

If your account balance is $100,000, with a 20% penalty and a 25% tax:

Penalty = 100,000 × 0.20 = 20,000

Tax = (100,000 - 20,000) × 0.25 = 20,000

Withdrawable amount = 100,000 - 20,000 - 20,000 = 60,000

Zakat = 60,000 × 0.025 = 1,500

You would pay $1,500 as Zakat.

Annual obligation:

Even if you do not withdraw funds from your retirement account, scholars generally recommend calculating Zakat annually on the withdrawable amount.

Deferred payment option:

If you lack liquidity to pay Zakat on inaccessible retirement funds, you may defer payment until withdrawal but must document it as a debt owed to Allah.

General guidelines

Dividends: Any dividends received from stocks or investments are subject to Zakat if they meet the nisab threshold and are held for one lunar year.

Deductions: Immediate debts or liabilities can be deducted before calculating Zakat.

Nisab threshold: Ensure your total wealth (including cash, investments, and other assets) meets or exceeds the nisab, equivalent to the value of approximately 85 grams of gold or 595 grams of silver.

Featured fundraisers

Discover 1.5K more

Join our newsletter

Join our community of 700k subscribers

Explore more