Home

>

Guide to eligible Zakat recipients

November 17, 2024

Zakat calculation made easy: a guide to eligible recipients and rules

By Yusuf Jaffar

•

3 min read

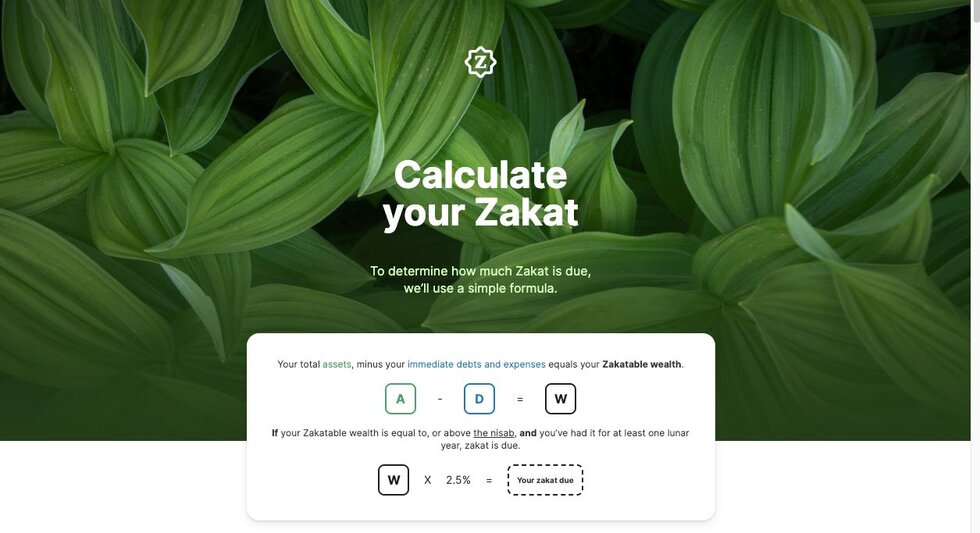

As you use our Zakat Calculator at launchgood.com/zakat/calculate, you may have questions about who is eligible to receive Zakat and the rules for distributing it. To ensure your Zakat aligns with Islamic teachings, we’ve compiled answers to some of the most common questions, organized under three key areas:

Who Can Receive Zakat?: A comprehensive guide on the eligible recipients of Zakat as prescribed by Islamic principles.

Can Zakat Be Given to Specific Groups or Places?: Clarifying whether Zakat can be allocated to non-Muslims, mosques, or other specific entities.

Can Zakat Be Given to Family?: Exploring the permissibility of giving Zakat to relatives, including parents, siblings, and others.

Who can receive zakat? A complete guide to eligible recipients

Zakat, one of the five pillars of Islam, is a powerful act of worship aimed at redistributing wealth and promoting social justice. The Quran specifies eight categories of eligible recipients in Surah At-Tawbah (9:60). While their traditional definitions remain constant, modern contexts allow for broader interpretations to address contemporary challenges. Below is a detailed guide to each category:

1. The poor (al-fuqara)

Traditional definition: Individuals who lack sufficient wealth to meet their basic needs.

Modern application: This category includes marginalized groups such as refugees, internally displaced persons, and those living in extreme poverty due to economic crises or natural disasters. For instance, during conflicts or pandemics, the number of individuals in this category often increases significantly.

Traditional definition: Individuals who lack sufficient wealth to meet their basic needs.

Modern application: This category includes marginalized groups such as refugees, internally displaced persons, and those living in extreme poverty due to economic crises or natural disasters. For instance, during conflicts or pandemics, the number of individuals in this category often increases significantly.

2. The needy (al-masakin)

Traditional definition: Those who have some resources but still fall short of fulfilling essential needs, such as food, clothing, and shelter.

Modern application: Includes individuals struggling with the high cost of living, single parents unable to provide adequately for their families, or workers with insufficient income to cover basic living expenses.

Traditional definition: Those who have some resources but still fall short of fulfilling essential needs, such as food, clothing, and shelter.

Modern application: Includes individuals struggling with the high cost of living, single parents unable to provide adequately for their families, or workers with insufficient income to cover basic living expenses.

3. Zakat administrators (al-aamileen)

Traditional definition: Individuals employed to collect, manage, and distribute Zakat.

Modern application: Extends to organizations and institutions that manage Zakat funds, such as NGOs and digital platforms. These entities are vital in ensuring transparency and efficiency in Zakat distribution. Please note there is a difference of opinion when it comes to this as these organisations are not government-appointed.

Traditional definition: Individuals employed to collect, manage, and distribute Zakat.

Modern application: Extends to organizations and institutions that manage Zakat funds, such as NGOs and digital platforms. These entities are vital in ensuring transparency and efficiency in Zakat distribution. Please note there is a difference of opinion when it comes to this as these organisations are not government-appointed.

4. Those whose hearts are to be reconciled (mu’allaf al-qulub)

Traditional definition: New Muslims or those inclined toward Islam who may need financial or social support to strengthen their connection to the Muslim community.

Modern application: This includes efforts to integrate new converts through education, community support, as well as providing aid to help with financial hardship stemming from social isolation.

Traditional definition: New Muslims or those inclined toward Islam who may need financial or social support to strengthen their connection to the Muslim community.

Modern application: This includes efforts to integrate new converts through education, community support, as well as providing aid to help with financial hardship stemming from social isolation.

5. Freeing slaves (fir-riqab)

Traditional definition: Assisting slaves in gaining their freedom.

Modern application: In modern times, this includes combating human trafficking, bonded labor, and other forms of modern slavery. It also covers rehabilitation programs for victims of such exploitation.

Traditional definition: Assisting slaves in gaining their freedom.

Modern application: In modern times, this includes combating human trafficking, bonded labor, and other forms of modern slavery. It also covers rehabilitation programs for victims of such exploitation.

6. Debtors (al-gharimeen)

Traditional definition: Individuals burdened with debts they cannot repay due to genuine financial hardship.

Modern application: This includes people overwhelmed by medical debts, those who have lost their livelihoods, or small business owners struggling to recover from economic downturns.

Traditional definition: Individuals burdened with debts they cannot repay due to genuine financial hardship.

Modern application: This includes people overwhelmed by medical debts, those who have lost their livelihoods, or small business owners struggling to recover from economic downturns.

7. In the cause of Allah (fi sabilillah)

Traditional definition: Efforts made for the sake of Allah, historically linked to defending Islam and promoting its cause.

Modern application: Contemporary interpretation encompasses a wide range of activities, including funding educational initiatives, supporting Islamic charities, building mosques, and contributing to disaster relief and healthcare projects.

Traditional definition: Efforts made for the sake of Allah, historically linked to defending Islam and promoting its cause.

Modern application: Contemporary interpretation encompasses a wide range of activities, including funding educational initiatives, supporting Islamic charities, building mosques, and contributing to disaster relief and healthcare projects.

8. The wayfarer (ibn sabil)

Traditional definition: Stranded travelers who lack the means to return home or continue their journey.

Modern application: Includes providing aid to refugees, migrants, or individuals stranded due to emergencies such as war or natural disasters.

Traditional definition: Stranded travelers who lack the means to return home or continue their journey.

Modern application: Includes providing aid to refugees, migrants, or individuals stranded due to emergencies such as war or natural disasters.

Find Zakat eligible campaigns below.

Can zakat be given to mosques, non-muslims, or other groups?

The permissibility of giving Zakat to mosques, non-Muslims, or other groups is a nuanced topic in Islamic jurisprudence. Rulings on this matter are derived from the Quran, Hadith, and scholarly consensus, with variations in interpretation based on context and necessity. Below is an explanation of these rulings:

1. Can Zakat Be Given to Mosques?

Some opinions:

Zakat cannot be directly given to mosques for purposes such as construction, renovation, or maintenance because mosques are public institutions and do not fall under the eight categories specified in Surah At-Tawbah (9:60). The primary recipients of Zakat are individuals, not institutions.

Exceptions:

If a mosque serves as a channel to distribute Zakat funds to eligible recipients (e.g., the poor or needy), this is permissible.

Some scholars include mosque-related purposes under the category "Fi Sabilillah" (in the cause of Allah), especially if the funds are used for religious education or services that are critical for the community. This remains a subject of scholarly debate.

Some opinions:

Zakat cannot be directly given to mosques for purposes such as construction, renovation, or maintenance because mosques are public institutions and do not fall under the eight categories specified in Surah At-Tawbah (9:60). The primary recipients of Zakat are individuals, not institutions.

Exceptions:

If a mosque serves as a channel to distribute Zakat funds to eligible recipients (e.g., the poor or needy), this is permissible.

Some scholars include mosque-related purposes under the category "Fi Sabilillah" (in the cause of Allah), especially if the funds are used for religious education or services that are critical for the community. This remains a subject of scholarly debate.

2. Can Zakat be given to non-muslims?

General rule:

The majority of scholars agree that Zakat is primarily for Muslims. Its purpose is to strengthen the Muslim community, promote Islamic solidarity, and address the needs of eligible Muslims. Non-Muslims are generally excluded from receiving Zakat under normal circumstances.

Exceptions:

Al-Mu’allafatu Qulubuhum (Those Whose Hearts Are to Be Reconciled):

This category allows Zakat to be given to non-Muslims if it may incline them toward Islam or strengthen their goodwill toward Muslims. This practice was established during the Prophet Muhammad's ﷺ time.

Contemporary views:

In non-Muslim-majority countries, some scholars advocate for a broader interpretation of this category. They argue that Zakat can be given to non-Muslims, especially People of the Book, in situations like humanitarian crises or to foster interfaith harmony. This remains a debated issue among scholars.

General rule:

The majority of scholars agree that Zakat is primarily for Muslims. Its purpose is to strengthen the Muslim community, promote Islamic solidarity, and address the needs of eligible Muslims. Non-Muslims are generally excluded from receiving Zakat under normal circumstances.

Exceptions:

Al-Mu’allafatu Qulubuhum (Those Whose Hearts Are to Be Reconciled):

This category allows Zakat to be given to non-Muslims if it may incline them toward Islam or strengthen their goodwill toward Muslims. This practice was established during the Prophet Muhammad's ﷺ time.Contemporary views:

In non-Muslim-majority countries, some scholars advocate for a broader interpretation of this category. They argue that Zakat can be given to non-Muslims, especially People of the Book, in situations like humanitarian crises or to foster interfaith harmony. This remains a debated issue among scholars.

3. Can Zakat be given to other groups?

General rule:

Zakat must strictly adhere to the eight categories outlined in Surah At-Tawbah (9:60). Groups or causes outside these categories—such as general public works, infrastructure projects, or non-eligible individuals—are not valid recipients of Zakat.

Exceptions:

Education, healthcare, and community development:

If these causes directly benefit Zakat-eligible individuals (e.g., the poor, needy, or those in debt) or fall under the category "Fi Sabilillah", they may qualify for Zakat funding. For example, Zakat could be used to sponsor education for poor children or provide healthcare for debt-ridden families.

For broader causes or groups not eligible under Zakat, Muslims are encouraged to give voluntary charity (Sadaqah), which has fewer restrictions.

General rule:

Zakat must strictly adhere to the eight categories outlined in Surah At-Tawbah (9:60). Groups or causes outside these categories—such as general public works, infrastructure projects, or non-eligible individuals—are not valid recipients of Zakat.

Exceptions:

Education, healthcare, and community development:

If these causes directly benefit Zakat-eligible individuals (e.g., the poor, needy, or those in debt) or fall under the category "Fi Sabilillah", they may qualify for Zakat funding. For example, Zakat could be used to sponsor education for poor children or provide healthcare for debt-ridden families.For broader causes or groups not eligible under Zakat, Muslims are encouraged to give voluntary charity (Sadaqah), which has fewer restrictions.

Can you give zakat to family members? What Islam says

Yes, Zakat can be given to family members under specific conditions, as outlined in islamic teachings. this act not only fulfills the obligation of Zakat but also strengthens family bonds. below is a detailed explanation:

Family members who can receive Zakat

Zakat can be given to family members who meet the eligibility criteria (e.g., being poor, needy, or fitting into one of the eight categories outlined in surah at-tawbah 9:60) and are not financially dependent on you. examples include:

Siblings (brothers and sisters)

Aunts and uncles (maternal and paternal)

Nephews and nieces

Cousins

Step-relatives (e.g., step-siblings or stepchildren)

Giving Zakat to these relatives is highly encouraged as it fulfills two virtues:

Charity (sadaqah): fulfilling the obligation of zakat.

Maintaining ties of kinship (silat ar-rahm): strengthening family relationships.

The prophet muhammad ﷺ said:

"charity given to a poor person is charity, but charity given to a relative is two things: charity and upholding ties of kinship." (at-tirmidhi)

Family members who cannot receive Zakat

Zakat cannot be given to family members whom you are islamically obligated to financially support, as doing so would indirectly benefit you. these include:

Parents and grandparents: direct ascendants whose financial needs you are religiously obligated to cover.

Children and grandchildren: direct descendants whose living expenses are your duty to fulfill.

Spouses: a husband cannot give zakat to his wife, and vice versa.

The reasoning is that Zakat must transfer ownership of wealth to someone else, whereas supporting these relatives is already your duty.

Key conditions for giving Zakat to family members

Eligibility: the recipient must qualify as Zakat-eligible (e.g., being poor, needy, or in debt).

Ownership transfer: the Zakat must fully transfer ownership of the wealth to the recipient.

No financial dependency: the recipient should not be someone whose living expenses you are obligated to cover.

Eligibility: the recipient must qualify as Zakat-eligible (e.g., being poor, needy, or in debt).

Ownership transfer: the Zakat must fully transfer ownership of the wealth to the recipient.

No financial dependency: the recipient should not be someone whose living expenses you are obligated to cover.

Benefits of giving Zakat to family members

The spiritual rewards of giving Zakat to family members are immense. not only do you fulfill your Zakat obligation, but you also gain the reward of maintaining family ties.

The prophet muhammad ﷺ emphasized this dual reward, making it a preferred form of zakat distribution when relatives are eligible.

Featured fundraisers

Discover 1.5K more

Join our newsletter

Join our community of 700k subscribers

Explore more